PREVIEW. What is the Physical Economic Model?

This is the conceptual mathematical dynamic model of the many-agent economic systems in the formal space of the independent variables, prices and quantities, of all the market agents. It is built through a significant analogy with the theoretical physical models of the many-particle systems in real space, but taking consistently into account basic, specific differences in the economic and physical systems. Each model is, in essence, only an imaginary construction, which by no means completely reflects genuine reality. It is, however, capable of describing one or several basic special features of structure or functioning of the market economy in sufficiently strict mathematical language. It was primarily created to provide fresh insight into these features, and, after the addition of another model feature or interaction, to understand, precisely how it influences entire end results.

1. The Basic Concept of Physical Economic Design

By stretching a point, we can say that the basic concept of design of our physical economic models is skeuomorphism. Let us explain what this concept means in our case. As we have already mentioned repeatedly in this book, when constructing physical economic models we strive to reach a formal mathematical, linguistic and even graphical similarity to their physical prototypes. Specifically, this concerns both the structure and the dynamics, as well as the language and the methods of representation of the obtained results, including graphics. We consistently follow this basic concept of design throughout the book. Let us stress another point. Our main task in the book is the construction of economic models that, in as much as possible, highly resemble or copy the known form and custom physicists’ models of many-particle systems. This facilitates understanding of the models and makes it possible to use the existing, detailed language of physics within a new economic framework. For example, the language of wave functions and probability distributions will be widely used here below, although this, of course, unavoidably leads to the appearance in the theory of a large quantity of neologisms. This may strongly hamper the reading of texts by economists, but substantially facilitates this process for specialists in the fields of natural sciences. We think that this basic design concept is quite adequate for building physics-based models of economic systems.

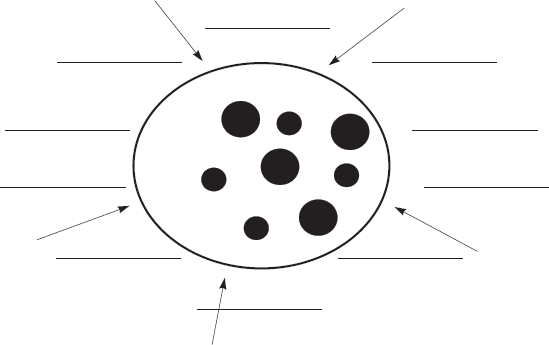

We begin with the requirement that the graphical scheme of the physical models must be similar to the picture of the many-particle physical systems, such as polyatomic molecules, for instance. Main elements of our physical models of economic systems are shown schematically in Fig. 1. A large sphere covers a market subsystem or economy consisting of active market subjects: buyers who have financial resources and a desire to buy goods or commodities, and sellers who have goods or commodities and a desire to sell them. They are the sellers and the buyers who form supply and demand (S&D below) in the market. Small dots inside the sphere denote buyers, and big ones denote sellers. The cross-hatched area outside the sphere represents the institutional and external environments, or more exactly, internal institutions such as the state, government, society, trade unions etc., and the external environment including other markets and economies, natural factors etc. It is evident that all elements and factors of the system influence each other; buyers compete with each other in the market for goods and sellers compete with each other for the money of buyers. Buyers and sellers interact with each other, permanently influencing each other’s behavior. Institutions and the external environment influence all the economic agents, including not only businesses but also ordinary people. In other words, all the economic agents are influenced by institutional and external environments and interact with each other.

Fig. 1. The physical model scheme of an economic system: a market consisting of the interacting buyers (small dots) and sellers (big dots) who are under the influence of the internal institutions and the external environment beyond the market (covered by the conventional imaginary sphere).

In order to develop a physical model of the economic system, it is necessary to learn to describe in an exact, mathematical way both movements (behaviors and influences) of each economic agent, i.e., buyers and sellers, the state and other institutions etc., and interactions with each other. It is the goal to derive equations of motion for market agents – the buyers and sellers – who determine the dynamics, movement, or evolution of the market system in time.

2. The Economic Multi-Dimensional Price-Quantity Space

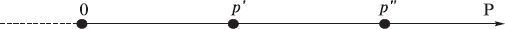

As we already discussed above, in order to show the movement or dynamics of an economy it is necessary to introduce a formal economic space in which this movement takes place. As an example of such space we can choose a formal price space designed by the analogy with a common physical space. We choose the prices Pi of the i-th item of goods as coordinate axes: i = 1, 2,…, L, where L is the number of items or goods (the bold P will designate below all the L price coordinates). In case there is only one good, the space is one-dimensional and represented by a single line. The coordinate system for the one-dimensional space is shown in Fig. 2.

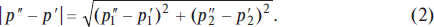

The distance between two points in one-dimensional space p' and p" can be for instance determined by the following:

If two goods are traded on the market (L = 2), the space is a plane; the coordinate system is represented in this case by two mutually perpendicular lines (see Fig. 3).

The distance between two points p' and p" can be determined as follows:

We can build the price economic space of any dimension L in the same way. In spite of its apparent simplicity, the introduction of the formal economic price space is of conceptual importance as it allows us to describe behavior of market agents in general mathematical terms. It represents realistic occurrences, as setting out their own price for goods at any moment of time t is the main function or activity of market agents. It is, in fact, the main feature or trajectory of agents’ behavior in the market. Let us stress once again that it is our main goal to learn to describe these trajectories or the distributions of price probability connected with them. It is impossible to do this in a physical space. For example, we can thoroughly describe movement or the trajectory of a seller with goods in physical space, especially if they are in a car or in a spaceship. However, this description will not supply us with any understanding of their attitude towards the given goods; nor will it explain their behavior or value estimation regarding the goods as an economic agent.

Fig. 2. The economic one-dimensional price space for the one-good market economy.

Fig. 3. The economic two-dimensional price space for the two-good market economy.